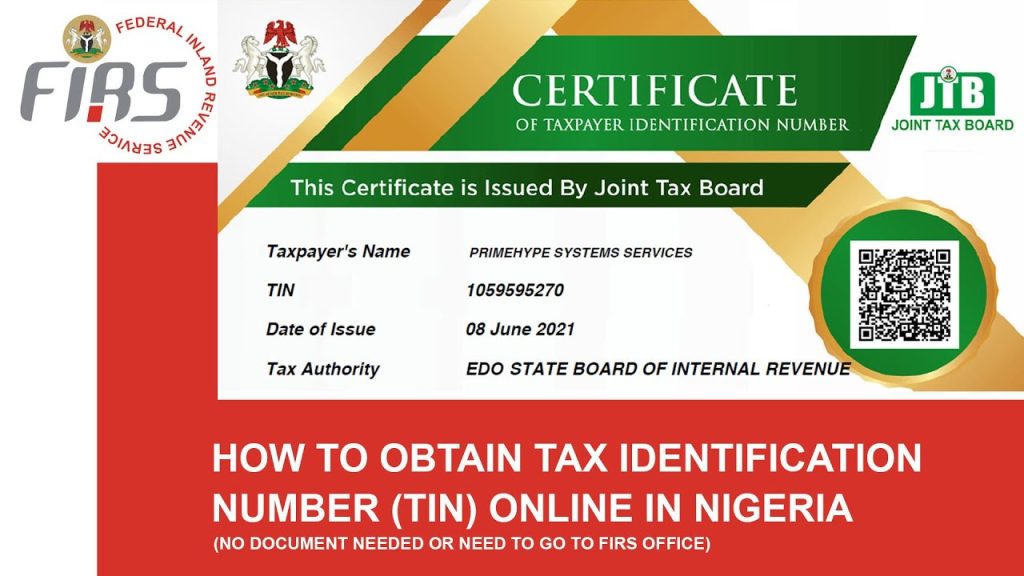

A Tax Identification Number (TIN) is a unique identifier issued by the Federal Inland Revenue Service, the federal tax authority in Nigeria. This number is crucial for identifying taxpayers, whether individuals or organizations.

One of the key situations where a TIN is essential in Nigeria is when opening a business or corporate account with a bank. However, the benefits of having a valid TIN extend beyond this. It helps prevent double taxation and is vital for tracking tax records.

Both individuals and organizations can obtain a TIN, though the process and requirements vary slightly for each. Fortunately, obtaining a TIN is free and can be done online by following these steps:

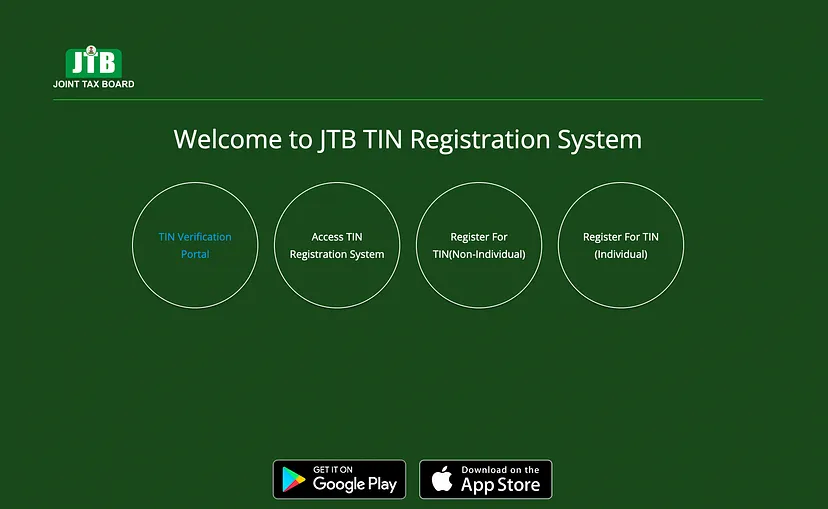

For Individuals:

- Visit the Joint Tax Board website.

- Click on “Register for TIN (Individual)”.

- Provide your BVN and a valid means of identification.

- Follow the instructions to complete the process.

For Organizations:

- Visit the Joint Tax Board website.

- Click on “Register for TIN (Non-Individual)”.

- Select your organization type, and provide your business name and registration number.

- Follow the instructions to complete the process.

Once the process is completed, your application will be approved, and you will receive your TIN. You can also verify your TIN on the same platform here.

Feel free to share this article with friends, colleagues, and business partners who may find it helpful.

Read also:

- Money changer sobs uncontrollably as club girls mistake him for a yahoo boy, steal 3 bundles of money

- Portable flaunts stacks of dollars barely 2 days in America

- Isbae U gets unexpected reply from Oba Solomon on whether he’s truly called by God

- Lady held by late Andrew for 6 days recounts her experience, how she escaped

- Man cries in restaurant after date fails to show up, vows to never ask a lady out again

- Cristiano Ronaldo Sets Record for Most Liked Comment After Congratulating Mbappe on Real Madrid Move

- Father acquires brand new laptops for all his 6 children

- Portable appreciates Davido as singer takes him out for dinner, gifts him designer shoes

- Lady takes grandmother to court for refusing to pay back N95,000 after 5 months

- Finance Minister Submits Cost Implications of Minimum Wage to Tinubu Thursday

- I Blame Myself – Mercy Eke Cries Out Over Heritage Bank Shutdown, Claims She Has Over 100m in Her Account

- Nigerian Man Who Provided Free Water For People to Fetch Shocked As Neighbour Locks it With Padlock

- Chess Master Onakoya Prepares for His ‘Toughest Match’ Against 12-Year-Old Prodigy

- Man confesses to having affair with married woman, prays he doesn’t get caught